Keeping You Informed Matters

Annual Investment Review January 2024

In 2023, markets displayed a significant paradigm shift, witnessing a positive reversal from the challenges of 2022, bolstered by economic recovery and better-than-expected corporate earnings. The year concluded on a positive note with optimism for global economies in 2024, driven by subsiding concerns over interest rates, economic growth, and inflation.

The Outlook

This time last year we wrote: “most economic and earnings forecasts fail, so we don’t aim to make precise forecasts for these.” This is just as well! Almost every economic forecast we read for 2023 was wide of the mark. The US economy did not suffer the widely-predicted recession – in fact, it appears to have been quite strong last year. And the Chinese economy, which many thought would rebound strongly from its Covid-19 lockdowns, recovered anaemically before heading into an economic malaise. China’s CSI-100 stock market index fell by 16% over the year, despite the initial optimism. In Europe, countries such as Germany, France and the UK did flirt with economic recession…but this didn’t seem to have much impact on asset prices overall. In fact, the Euronext 100 Index of European stocks rose approximately 13% in 2023 and the FTSE All-Share Index rose around 4%.

There were two major scares for investors during 2023:

- In March there was a wave of US bank failures, including Silicon Valley Bank and Signature Bank. At around the same time, in Switzerland, UBS had to step in to save Credit Suisse from failure. Shares around the world fell on these events, but when the US Federal Reserve boosted banks’ access to liquidity – to stop further failures – stock markets recovered strongly.

- After ‘flip-flopping’ for most of the year, US and European bond yields surged higher in October for reasons that are not yet fully understood. This meant sharp falls in bond prices, and shares slumped too. This reversed in November when benign inflation data was released. Shares and bonds then surged higher in December when the US Federal Reserve said it expected several cuts to policy interest rates in 2024.

The rough pattern here was that a shock of some sort sent asset prices lower, only for the US Federal Reserve to respond by boosting liquidity expectations, sending asset prices higher. It would have been quite easy to get scared out of investing when these shocks took hold. Looking back, though, staying invested was the ‘winning’ strategy.

Changes in inflation expectations seem to have been the main driver of nearly all markets since the surge in inflation of 2021. The past year brought good news to most western consumers and investors, in the form of lower headline inflation, and lower core inflation (inflation excluding volatile items). This probably means that we have seen the peak of interest rates for this cycle. Markets have already ‘factored in’ several rate cuts for the year ahead.

Artificial intelligence (AI)

Another big event last year was the public launch in April of the AI tool, ChatGPT. This captured the imagination of millions around the world and led to a burst of experimentation. Rival technology firms, which for years had been developing AI capabilities, rushed to launch their own tools and there was a surge of investment in microchips and data centres to facilitate this phenomenon. There was also a rush to secure large datasets upon which to train AI programmes. Publishers and media organisations, such as Axel Springer and the Associated Press, secured agreements with OpenAI (ChatGPT’s owner) worth “tens of millions of dollars” for the use of their content. By contrast, The New York Times sued OpenAI and Microsoft over copyright, arguing that these firms should be held responsible for the “unlawful copying and use of The Times’s uniquely valuable works.” Clearly, quality ‘content’ and data are useful to AI developers!

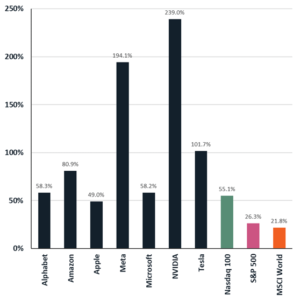

Regulators in China, Europe and the USA were also busy setting out a framework for dealing with AI issues. In the meantime, stocks with an AI flavour took off. The main beneficiary was Nvidia, a US semiconductor firm, whose chips are currently best suited to AI applications. Despite already being a large company, Nvidia’s shares rose 239% in 2023 and the firm ended the year at around a $1.2 trillion valuation. Microsoft, with a stake in Open AI, plus other AI interests, rose by 57% to a $2.8 trillion valuation.

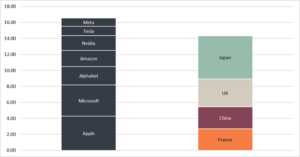

Several other large US technology stocks out-performed the market, such that the largest seven (dubbed the Magnificent Seven by some) now comprise around 30% of the S&P 500 Index – a high concentration by historical standards. The largest of these, Apple, is valued at $3 trillion – larger than the entire French or German stock market. But Apple has faced a series of recent setbacks: sales actually fell over the past four quarters, the firm lost a copyright case over technology embedded in its Apple Watch product; Chinese phone-maker Huawei made a technological breakthrough – in the face of US government constraints – that is helping it take market share against Apple in the profitable Chinese market; and the Chinese government has curbed employees’ use of Apple phones, as part of the battle between US and Chinese state interests.

Other Magnificent Seven stocks face headwinds too: both Amazon and Google are the subject of recent US anti-trust actions from the Federal Trade Commission, which may lead to large fines, and the eventual break-up of these behemoths.

‘Big tech’ share prices shall probably reflect a struggle between AI-optimism and regulatory tensions; between growth opportunities and intense competition; and between share price momentum and heady valuations. It won’t be boring!

Although large US tech stocks performed well last year – recovering from their losses in 2022 and in some cases hitting new record highs – tech stocks were not the best performing asset class or sector of 2023.

That honour goes, perhaps surprisingly, to…cryptocurrencies! Bitcoin, for example, rose 84% in the year. And this was despite the collapse of cryptocurrency trading platform, Binance, and the conviction for fraud and conspiracy of FTX platform founder and CEO, Sam Bankman-Fried (the latter purportedly losing $16 billion in just days). A popular investing adage is: “The bubble never re-inflates” but Bitcoin has experienced five bubble bursts in the past 13 years and is re-inflating again. There are not many historical precedents for this type of market behaviour! It would be possible to argue that 2023 was simply a “year for speculative assets”, but not all speculative vehicles did well. We saw the widespread collapse (and even bankruptcy) of many Special Purpose Acquisition Corporations (a.k.a. ‘blank cheque’ companies); but also, meme-stocks like Gamestop and AMC; and the equity of many profitless tech firms (Bird Global, the urban electric scooter ‘Unicorn’ which was once valued at $2.5 billion, being the latest to go bust, just this December). In summary, some speculative vehicles did very well, while others collapsed.

Bonds, currencies and property

Government bonds, often thought of as “safe investments” and the backbone of a diversified portfolio, were very volatile during 2023, flip-flopping violently from month to month. In the US and UK, government bonds ended the year at pretty much the same yields as they started. They thus offered lots of volatility, but little progress.

In currency markets, the US Dollar weakened during the year. The Yen was even weaker initially, but has since recovered somewhat, likely in anticipation of policy interest rates being raised from negative levels. Japan is the only major developed nation not to have raised rates in response to higher inflation these past two years. Perhaps, after years of price stability or modest deflation, some inflation was welcomed by policy makers.

Around the world, residential house prices generally fell, especially in countries with high leverage and a high proportion of variable rate mortgages. Swedish house prices, for example, fell roughly 15% last year. Smaller drops were seen in countries (such as the USA) that tend to use long-term fixed-rate mortgages. The UK was somewhere in the middle, experiencing modest nominal price falls (roughly 5% off the peak), though these are larger when measured in real (inflation-adjusted) terms. Perhaps these falls are merely a sensible rebalancing, given that ‘house price to income ratios’ in many countries have been at historically high levels, stretching affordability for many.

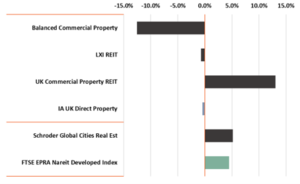

Commercial property prices (e.g. offices, retail, industrial and logistic) generally fell over the past year, as widely anticipated. This is partly due to higher interest rates (recall that property is valued periodically by professional appraisers using ‘capitalisation rates’ that are related to interest rates and risk) and partly due to changing behaviour: companies re-assessing the need for city centre office space; and the closure of many department stores. Nevertheless, real estate investment trusts (REITs) in the UK ended the year on a firm note. Possible reasons for this include expectations for lower interest rates as inflation falls, a series of take-over bids that highlight the discounted valuations of many REITs, plus resilient dividend payments. Our best estimate is that many of these discounted REITs will provide attractive total returns, but that returns will remain volatile for as long as interest rates remain volatile.

Politics

Geopolitics remains dangerous and unpredictable: the war in Ukraine continues, with little prospect of an imminent resolution. At the time of writing, the Israel/Hamas war continues, with only limited regional escalation, but much fear for those involved today, and for any prospects of long-term peaceful co-existence.

The trade battle between the USA and China gradually ratcheted upwards during the year, albeit with some nascent signs that China now seeks better international relations.

In the USA, 2024 is an election year and Donald Trump currently leads in the opinion polls and in political betting markets. Trump’s policy proposals are becoming clearer and can best be described as ‘isolationist’ – with barriers to imports and to immigrants, and a possible exit from NATO. Trump is also seeking the power to directly appoint (and fire) senior federal agency staff and civil servants. This could be akin to a ‘purge’, a phenomenon mostly associated with autocratic leadership. Where might this lead?

Gold, sometimes seen as a barometer of geopolitical risks, rose 6% last year in Sterling terms. Central banks, especially those in developing nations, have been net buyers of gold. The reasons for this are rarely made public, though some observers believe it is part of a strategy to reduce reliance on US Dollars (and thus US policy) when it comes to national reserves.

Natural gas prices fell back sharply, -71% since peak in August 2022 to December 2023. The earlier increase had been, at least partly, due to speculators buying liquid natural gas (LNG) before the main European gas suppliers did, in a scramble to replace gas previously sourced from Russia. A mild winter in 2022/23 helped calm this market. There has also been an important restructuring of global supply chains: data provider, Kpler, shows that most sea-exported Russian fuel is now going to India and China. Europe is now predominantly importing LNG from non-sanctioned nations. The result is that the market has now re-balanced. Lower natural gas prices in Europe represent good news for European consumers and their governments, many of whom (including the UK) were borrowing money to subsidise energy supplies to consumers last year.

A closer look at China

Taken at face value, China’s economy appears to be doing well, growing moderately and consistently (4.9% annual GDP growth being the latest measure). Beneath the surface, though, there are plenty of concerns. For example, consumer prices are exhibiting deflation, suggesting weakness in consumer spending. Youth unemployment hit a record high of 21.3% in the summer, prompting authorities to abandon publication of future figures. A series of large property developers, including Evergrande and Country Garden, are in financial distress and this has led to the failure of several large, property-linked retail savings products. Inwards Foreign Direct Investment recently went negative for the first time in many years, indicating low confidence from foreign companies in medium-term Chinese prospects. In short, the entrepreneurial spirit and confidence that we often associate with Chinese investors, consumers, and business folk, has gone missing. House prices and shares are falling.

Despite their credible AI-potential, big Chinese technology stocks such as Alibaba, Tencent and Baidu are languishing at lowly valuations. This might be due to a sweeping national security crackdown that is denting business confidence; or poor access to accurate information; or worries over trade barriers. Whatever the reasons, the contrast between Chinese technology stocks and their US peers is striking.

Corporate and government debt levels in China have ballooned in recent years, and local government debt is an acute concern at present. Land sales, which had been a big source of local government revenue for years, are now difficult given the distress of many real-estate firms. But local authority debt levels are massive. To illustrate this, Birmingham (which is the largest council in the UK, and possibly in Europe) went “effectively bankrupt” in 2023 with total liabilities of just under £1bn. By comparison, Chinese local authority debt is estimated by Reuters to be $9 trillion. This is 7,000 times more than Birmingham (for reference, China’s population is 21 times that of the UK). It very much looks like a debt-fuelled property boom that has ended, and that is spreading out into the wider economy.

Despite this, China has some highly competitive companies, a well-educated workforce and a clear national strategy aimed at industrial leadership. Further, it would not be surprising to see government stimulus designed to boost the economy in the year ahead.

We do not hold any direct China funds, though our emerging markets funds will contain some Chinese stocks. However, many multi-nationals that are popular with investors, such as Apple, Nike, and Tesla, earn a meaningful share of their profits in China… and yet they trade at considerably higher multiples than their Chinese equivalents. This could be a mis-priced risk.

How we invested

Ever since the inflationary shock of 2021, bond and equity returns have become positively correlated (moving together), after roughly twenty years of negative correlation. Everything else equal, this means that a portfolio of bonds and equities is less diversified and more volatile than it was in the previous two decades. We need more diversification to get the same risk in portfolios.

To deal with this challenge, we hold a broadly diversified pool of assets, including equities, bonds, real estate investment trusts, some gold (in the form of an exchange-traded certificate of physical gold at the Royal Mint) and alternative assets (e.g. renewable energy funds and structured product funds).

We made no dramatic changes of direction in 2023. This was helpful, as the biggest investing mistake would have been to sell assets (for cash) at the moments of intense market stress, such as in March (when a series of banks failed) or in October (when bond yields spiked, and asset markets slumped).

With respect to the huge US technology stocks that dominated indices and headlines for much of 2023, we do own Nvidia, Microsoft and other Magnificent Seven stocks in portfolios (primarily via ‘global growth’ funds) but we are not so concentrated as the market as a whole. This is prudent, albeit of limited excitement.

A modest change during the latter part of the year was to reduce exposure to high-yield bonds, where we believed that the potential rewards did not fully compensate for the risks involved. This was based on an examination of high-yield bond spreads over government bonds through time, and a consideration of possible economic scenarios in the years ahead. In their place, we added to short-dated, investment-grade bonds – a lower risk alternative.

Within equities, the UK stock market stands out. On average, UK-listed firms trade at lower prices than similar firms in other countries. This is sometimes said to be due to UK exceptionalism (that the UK is a uniquely bad place to do business) but UK economic statistics over the past few years have looked (and still look) remarkably similar to those of France, Germany or the Netherlands, say. Many low-priced UK shares relate to companies that trade globally, and we find their low valuations to be an attractive anomaly.

There weren’t many IPOs last year, but the most prominent was ARM – a global chip design company that is headquartered in Cambridge. When deciding where to list, ARM chose the US NASDAQ market. Why did they do this? Almost certainly, because they thought their shares would trade at a higher price on this market than on the London Stock Exchange: ‘same company, different valuation’ depending on where it’s listed! These things ebb and flow over time – there’s nothing permanent here. Fifteen years ago, global mining and commodity trading firms like Swiss-based Glencore floated on the London Stock Exchange, as this was where they thought they’d achieve the highest share price amongst global exchanges.

At the same time, we’ve seen lots of take-overs of UK firms at large premiums, mainly by US private equity firms. Why? Almost certainly because they thought these were good long-term investments. There’s a message to investors here. Large professional investors (private equity managers) and insiders (company directors) want to sell you shares at US prices (as with ARM’s IPO), but wish to buy shares from you at UK prices (as with the take-over bids). In our view, you shouldn’t do what they want you to do. Instead, you should do exactly what they themselves are doing: selectively selling shares at US prices, to buy shares at UK prices.

Outlook

Of course, we had to ask ChatGPT about asset prices for the year ahead. It replied: “I’m sorry, but I cannot predict specific future events, including the performance of specific assets in 2024.” It went on, though – quite sensibly – to suggest that investors should diversify their assets and be mindful that past performance was not a guide to the future. We should “make choices based on our financial goals, risk tolerance, and time horizon.” So, AI tools can certainly be helpful for investors. They’re just not prescient.

For the year ahead, there is plenty to worry about: debt, deficits, demographics, climate change, social change, geopolitics. Worries, however, are normal and we should invest with these problems in mind. As markets ‘price in’ a soft landing in the US economy, it’s probably a good time to remove those assets that have risen in price on this possibility, but that aren’t cheap relative to others, or to their own history. High yield bonds are one of those asset classes. There may be others in the year to come. Remember, no one knows whether there’ll be a US soft landing or a recession.

Within bonds, high-quality, short-dated bonds offer returns that are likely to be above inflation with very low risk. Longer-dated bonds usually offer protection against a recession but are more volatile in general. They should form part of a diversified portfolio.

UK equities, especially smaller and mid-cap stocks, look very attractive when comparing likely future cash flows to share prices. Japanese equities are also interesting, but more complicated. The possible ending of the Bank of Japan’s ‘yield curve control’ policy, which includes negative short-term rates, would mark a change in monetary ‘regime’ for Japan. Removing this emergency measure could lead to a normalisation that boosts Japanese asset prices, after more than thirty years of malaise. Japanese shares are currently cheap compared to the USA, and about average relative to recent history. They also have upwards price momentum.

Some gold in a portfolio will likely be helpful. Around the world, governments are spending with profligacy: the US is exhibiting war-time levels of fiscal deficit; China is increasing borrowing to boost infrastructure and social spending; and in the UK, we’re likely to see unfunded tax cuts ahead of an election. Gold represents ‘non-paper money’ and provides a hedge against ill-disciplined government Treasuries.

Our portfolios hold several of the prominent US technology stocks, but not in such a high concentration as currently seen in major indices. More speculative assets, such as Bitcoin, are beyond our risk tolerance.

A lot is going to happen in 2024. A well-diversified, value-cognisant and risk-conscious portfolio is likely to defend well in most situations and to thrive in the sunnier scenarios.

The Year in Charts

World stock market returns in GBP

The US tech “Magnificent 7” dominate markets.

Source: Morningstar. Share price returns in USD for 2023.

The Magnificent 7 as a component of the MSCI World index.

Source: Morningstar. The combined weight of the Magnificent 7 in the MSCI ACMI World index is greater than that of Japan, UK, China and France together. Data as at 31/12/2023.

A volatile year for government bond yields.

Source: Morningstar. After a volatile year, yields end near where they started. Data for 2023.

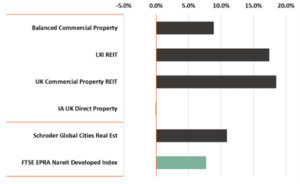

UK listed Real Estate Investment Trust (REIT) performance – Q4 Recovery.

Source: Morningstar. (Left) UK REITs recover well in Q4, but mixed performance over the full year (Right). Data for period 30/09/2023 to 31/12/2023 (l) and 31/12/22 to 31/12/23 (r).

Key facts about the world

United Kingdom

- There is pressure on the Bank of England to cut rates from their 15-year high of 5.25%, as inflation fell to 3.9% in November, its lowest since September 2021.

- The UK economy shrank by 0.1% in Q3, after a downward revision from the previous estimate of zero growth.

Europe

- Spain has extended its windfall tax on banks and energy companies by an extra year, to 2025, with it set to have raised €3bn in 2023.

- The EU has agreed a €20bn support package for Ukraine, after an original deal earlier in December was blocked by Hungary.

- Eurozone inflation rose unexpectedly to 2.9% in December.

Asia

- Since peaking at Rmb235bn ($33bn) in August, net foreign investment in China-listed shares this year has dropped 87 per cent to just Rmb30.7bn.

- Israel has warned of a growing risk of a regional conflict in the middle east as tensions with Iran have increased.

- The Bank of Japan held off on lifting negative rates, sending the Yen lower to 144.67 against the dollar. The overnight rate was held at -0.1%.

North America

- US inflation cooled further in November to 3.1%, and the suggestion from the Federal Reserve that there could be up to 4 rate cuts in 2024, helped drive an ‘everything’ rally, in stocks and bonds.

- Following 10-years of decline, US corporate bankruptcies rose by 30% in the year to September.

South America

- Argentina elected radical libertarian Javier Milei in its presidential election. He has promised ‘shock therapy’ in an attempt to fix the country’s economy.

- A copper mine in Panama, that produces 1.5% of the world’s supply, has been shutdown, and all future projects have been banned due to escalating protests against the practice in December.

Africa

- Egypt’s Abdel Fattah al-Sisi won a third term as president of the country, securing 89.6% of the votes, his only serious challenger dropped out of the race in October, and is now facing charges of illegally circulating endorsement forms printed off the internet.

- Somalia is to re-join the global financial system, after it secured a debt-relief deal totalling $4.5bn with the IMF.

2023 Performance Review

Unconstrained strategies

Key facts

US Federal Reserve interest rate pivot sparks strong ‘Santa Rally’ and end to the year.

Late surge benefits MM Wealth strategies, which finish on a positive after challenging year.

Bond market revival to close out 2023 as yields fall sharply and prices rise on interest rate cut expectations.

Strong performance from UK and Global equities, particularly for mid and small-sized companies into year end.

Summary

The Magnificent 7 US tech companies played less of a role in markets towards the end of the year, as an interest rate pivot from policymakers allowed wider markets to enjoy the festivities through December and the seasonal Santa Rally. It was mainly China that ended the 4th quarter down, which broadly leaves investors flat to positive for the year from holding a globally diversified portfolio of assets.

For MM Wealth strategies after a weak middle to the year which reversed the early positivity for 2023, the late surge saw all risk categories return between 5-7% for the quarter. They also end the full year on a positive note. A feature of markets has been the performance of large and mega-cap companies driven by the AI/tech boom, but with suggestions that interest rate cuts could potentially arrive earlier in 2024 than previously indicated, the longer duration, small-cap companies enjoyed a renaissance.

This was most stark in bond markets, where anything with long maturity dates (over 10 years to repayment of the original loan) that had been underwater until the final quarter, saw yields plummet from decade highs in October, with prices surging as much as 11% as in the case of the L&G All Stocks Index Linked Gilts (+10.8% from end of October, +8.2% for the quarter). The Lyxor Core UK Government Bond also enjoyed similar returns, +8.5% for the quarter.

While shorter duration high yield bonds had provided better returns over the course of the year, the change in dynamic for bond markets saw our lower risk strategies trade out of the AXA US Short Duration and Royal London Short Duration High Yield funds, into a new position in the iShares $ Treasury 1-3 Year Bond ETF and recent addition Vontobel Sustainable Short Term High Yield fund. This effectively achieves a similar level of return, but for less risk, where the potential for returns from high yield is less attractive now that higher yields are available from higher quality bonds.

In UK equities, the Montanaro UK Income and River & Mercantile UK Recovery funds which have exposure to mid and small sized companies performed well, returning +7.2% and +5.6% in Q4 and +7.8% and 10.3% for the year after lagging earlier. The JO Hambro UK Opportunities (+4.7%) and BlackRock UK Income (+4%) rounded out a positive year as well (+6.6% and 10.8% respectively), leaving this element of strategies with returns in line with their relevant UK benchmarks.

For global equity positions, after muted returns from most regions over the course of the year, strong performance from the Premier Miton European Opportunities fund (+14.3%), Regnan Global Equity Impact Solutions (+12.3%) and Xtrackers S&P 500 Equal Weight ETF (+11.7%), propelled this element of portfolios into a strong year end. All have exposure to smaller companies and in the case of the Xtrackers ETF, it was the wider US market outside of the mega tech companies that enjoyed a return to form over the year end. However, portfolio mainstay the Natixis Loomis Sayles US Equity Leaders fund continued its strong performance, +10% for the quarter and finishing +44.3% for the year.

For Alternatives, gold continued its strength in Q4 with the Royal Mint Responsibly Sourced Gold ETC returning +6.7%, reflecting the ongoing uncertainty for the year ahead, despite the late animal spirits. Concerns have remained over the performance of the real estate investment trusts (REITs), however these also enjoyed a boost in the quarter. There was also merger news with LondonMetric and LXI REIT, which gave us the opportunity to exit the position in LXI while prices recovered and volumes were high. This was reallocated to bonds, where similar yields are achievable for significantly less risk.

| SECTOR | Q4 2023 | 1 year to 31/12/23 | 1 year to 31/12/22 | 1 year to 31/12/21 | 1 year to 31/12/20 | 1 year to 31/12/19 | 5 years (annualised) |

|---|---|---|---|---|---|---|---|

| IA UK Index Linked Gilts |

9.5% |

0.5% | -35.3% | 3.9% | 11.9% | 5.9% | -4.4% |

| IA £ Corporate Bond | 7.8% | 9.3% | -16.4% | -2.0% | 7.9% | 9.5% | 1.1% |

| IA Property | -0.1% | -0.4% | -7.8% | 7.4% | -3.8% | -0.8% | -1.2% |

| IA UK Equity Income | 4.6% | 7.1% | -2.2% | 18.3% | -10.9% | 20.1% | 5.8% |

| IA UK Smaller Companies | 6.8% | 0.4% | -25.6% | 20.6% | 7.0% | 25.4% | 3.9% |

| IA North America | 7.2% | 16.7% | -10.1% | 25.2% | 16.5% | 24.6% | 13.8% |

| IA Europe Excluding UK | 8.1% | 14.3% | -8.9% | 15.6% | 10.5% | 20.4% | 9.9% |

| IA Japan | 3.8% | 11.0% | -8.4% | 1.6% | 13.9% | 17.1% | 6.6% |

| IA Asia Pacific Excluding Japan | 2.5% | -0.9% | -6.8% | 1.5% | 19.9% | 15.8% | 5.4% |

| IA Global Emerging Markets | 3.5% | 4.3% | -12.3% | -0.3% | 13.6% | 15.7% | 3.7% |

Source: Morningstar in GBP. Net income reinvested. Past performance is not a reliable indicator of future results.

The positioning of our Unconstrained strategies

Cautious

Growth

Balanced

Adventurous

2023 Performance Review

Ethical strategies

Key facts

New commitment to end use of fossil fuels at COP28, but political will is not in unity and challenges persist.

Growing trend in regulatory changes aimed at increasing transparency and accountability in ESG and responsible investing.

Advances in AI and big data enabling better analysis and monitoring of ESG criteria.

Ongoing shift in consumer and corporate behaviour to sustainable practices influencing investment trends.

Summary

Despite the mixed successes, perceived or otherwise, of COP28 in November – the 28th UN climate meeting, or Conference of Parties – the seasonal Santa Rally also lifted the spirits of sustainable and ethical investors in Q4. While new commitments were made towards the transition away from fossil fuels to clean energy, and a loss and damage fund was established to address the impact of climate change for vulnerable countries, much work is still needed and challenges remain which will impact investment decisions ahead.

For MM Wealth strategies after a weak middle to the year which reversed the early positivity for 2023, the late surge saw all risk categories return between 5-7% for the quarter. They also end the full year on a positive note. A feature of markets has been the performance of large and mega-cap companies driven by the AI/tech boom, but with suggestions that interest rate cuts could potentially arrive earlier in 2024 than previously indicated, the longer duration, small-cap companies enjoyed a renaissance. This is particularly beneficial for companies focused on sustainable and ethical practices, which by their nature are often younger and in the earlier stages of their growth cycle.

For bond allocations, we have seen solid performance as yields fell on interest rate expectations and prices rose. The Aegon Ethical Corporate Bond, Liontrust Sustainable Future Corporate Bond and Rathbone Ethical Bond funds all enjoyed strong returns in Q4, +8.4%, +10.6% and +7.2% respectively. The newer EdenTree Global Impact Bond fund, focused on the new green bond market, also ended the year well, +7.2%.

In equities, the majority of returns were achieved in Q4. At home, the Aegon Ethical Equity fund +13.3% for the quarter, and +14.9% for the year, abrdn UK Ethical equity (+8.5% and +10.9%), CT Responsible UK Income (+7% and +8.9%) and Janus Henderson UK Responsible Income (+8.9% and +13.1%), all contributed well to total returns.

Globally, with a strong end to the year we were able to take advantage of price recovery in the FP WHEB Sustainability fund in the quarter and switch to new positions in the iShares US Equity ESG Index tracker and EdenTree Responsible & Sustainable European Equity funds. The WHEB fund has been disappointing on performance and under review for some time and following a partial rebound in price, albeit behind the benchmark and wider peer group, we used the opportunity to reposition.

We were not aiming to reduce exposure to core US markets, given the reduced likeliness of a recession and ongoing economic resilience, so switched part of the position to the iShares US ESG tracker, which provides low-cost access to this region. Europe has also been more resilient than earlier forecasts and the EdenTree team is well established, resourced and respected for its approach to ethical investment process and selection, adding further diversification to the strategies.

In the higher risk strategies, we also made a change in emerging markets, switching the JP Morgan Sustainable Emerging Markets fund into the Vanguard ESG Emerging Markets All Cap Equity Index fund. During our ongoing monitoring, we identified a position in the JPM fund that breached one of our exclusion criteria, involved in the production and distribution of alcohol. At a suitable opportunity we replaced the position with the Vanguard fund, which is a low cost, lower volatility approach that meets our full criteria.

| SECTOR* | Q4 2023 | 1 year to 31/12/23 | 1 year to 31/12/22 | 1 year to 31/12/21 | 1 year to 31/12/20 | 1 year to 31/12/19 | 5 years (annualised) |

|---|---|---|---|---|---|---|---|

| Global Sustainable | 6.6% | 12.9% | -10.0% | 19.7% | 10.3% | 19.8% | 10.0% |

| UK ESG Enhanced | 3.4% | 10.8% | -3.7% | 19.0% | -11.7% | 20.2% | 6.1% |

| US ESG Enhanced | 7.2% | 20.0% | -11.1% | 29.8% | 16.9% | 27.4% | 15.6% |

| Developed Market Europe Sustainable | 8.1% | 13.7% | -11.4% | 20.3% | 9.0% | 22.8% | 10.2% |

| Emerging Market ESG Enhanced | 2.8% | 2.2% | -11.1% | -2.6% | 8.6% | 11.5% | 1.4% |

| UK Corporate Bond Sustainable | 9.1% | 9.6% | -20.7% | -3.4% | 9.0% | 10.8% | 0.3% |

| Global Corporate Bond Sustainable | 4.5% | 3.4% | -6.9% | -2.7% | 7.6% | 6.7% | 1.5% |

| Global Green Bond | 6.0% | 4.4% | -13.0% | -7.0% | 9.3% | 2.3% | -1.1% |

| Global Renewable Energy | 3.7% | 1.9% | -1.2% | 12.0% | 23.7% | 20.3% | 10.9% |

Source: Morningstar sustainable indices in GBP. Net income reinvested. Past performance is not a reliable indicator of future results

The positioning of our Ethical strategies

Cautious

Growth

Balanced

Adventurous

Disclaimer

Opinions constitute our judgment as of this date and are subject to change without warning. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The information in this document is not intended as an offer or solicitation to buy or sell securities or any other investment, nor does it constitute a personal recommendation.