Keeping You Informed Matters

Annual Investment Review January 2025

Markets in 2024 witnessed dramatic surges and stark contrasts, with cryptocurrencies and AI-themed stocks leading gains, while bonds and property largely underwhelmed. Political shifts, including Trump’s election victory, and global fiscal challenges, shaped investor sentiment and asset performance. As we head into 2025, uncertainty abounds, but opportunities remain for balanced, sensibly diversified portfolios navigating a rapidly evolving landscape.

The Outlook

“To travel hopefully is a better thing than to arrive” – Robert Louis Stevenson

Once it became clear that Donald J Trump would be inaugurated US President on January 20th, a select set of financial assets began an incredible journey. No one knows how this journey will end, but the ride so far has been spectacular. Amongst those travelling hopefully have been cryptocurrencies, such as Bitcoin, Ether and Dogecoin, which rose by around 60% in the month after the election. This surge added over $1 trillion in size to cryptocurrencies, so this is no fringe event!

The next set of assets to soar were firms-related to cryptocurrencies. MicroStrategy, a firm that owns cryptocurrencies on margin, more than doubled in the three weeks after Trump’s victory, ending the year with a market capitalisation of approximately $80bn. For perspective, this would put MicroStrategy in the ‘top ten’ of UK companies by size!

Next up comes those who backed Trump with money or other forms of assistance. Elon Musk is probably the most prominent of these, and his listed company, Tesla, almost doubled in price in the six weeks after the election. It ended the year with a market capitalisation of close to $1.4 trillion, or about seven times greater than the largest UK-listed firm, AstraZeneca (itself a highly profitable global technology-rich firm). Tesla trades on 207 times consensus expected 2024 earnings (the price reflects future earnings, suggesting earnings will increase 207 times from where they are now – how realistic is this?). For comparison, Hyundai Motor Company, which is listed in South Korea, trades on a mere 4 times consensus 2024 earnings. It’s true that Hyundai sells petrol-engine as well as electric vehicles, but Hyundai also owns Boston Dynamics, one of the world’s most advanced robotics firms, so it’s no dinosaur.

Finally, stocks with an artificial intelligence (AI) theme recovered from their July swoon, with many of them rising to all-time highs in the weeks after the election. Favoured US stocks such as Nvidia, Broadcom, Apple and Alphabet were amongst the leaders, helping cap out a strong year for large US stocks.

Outside the USA, most assets languished or drifted lower after the election. Even the currencies themselves drifted lower against the Dollar. In short, the ‘Trump trade’, plus a revival of the AI trade, dominated global investor attention and performance towards year end. The journey was spectacular – what will arrival on January 20th be like? More on this below in our outlook section.

What are bond markets saying about the state of the world?

UK and US bonds were rather disappointing investments last year. There were modest gains from shorter-dated bonds (those due to mature within a couple of years) as their prices held steady while they generated income. But longer-dated bonds saw rising yields and thus capital losses, which weighed against the income generated. Government bond funds generally delivered small losses for the year, while most corporate bond funds (which take additional credit risk) produced small profits. Overall, it was dull, and quite the contrast to cryptocurrencies and AI stocks over the year.

All of this happened while US, UK and European central banks cut policy interest rates in 2024, as soon as they saw price inflation finally come back to target. Typically, long dated bond yields fall when policy rates are being cut, and so it seems odd that these long bond yields rose instead. What’s going on? Does this discordant note signal something about the state of the world, that can help us navigate the future? As usual, there are plenty of competing theories as to what it signals: Trump’s desire for big tax cuts, or Reeves’ spending plans, or political woes in France. Other possibilities include reduced foreign demand for US government bonds, considering US willingness to freeze accounts or impose sanctions on nations in conflict with it. Maybe it’s all these things together. But in so many countries worldwide, governments are running large fiscal deficits, with no meaningful plans for restoring balance other than vague hopes for cutting waste or boosting growth. Out-of-control fiscal deficits signal inflation, and it’s quite possible that the bond market is telling us that inflation is coming to the USA, UK, France, Japan…

Something quite different has been going on in China, where government bonds performed well, with yields falling to new lows and thus providing capital gains on top of income. Chinese ten-year yields fell below 1.7%, even as US ten-year yields rose above 4.5%. Both the Chinese and US governments have piles of debt and run sizeable fiscal deficits, so it’s interesting to see their bonds moving in completely different directions. So why are Chinese bonds behaving so differently? After the bursting of its real estate bubble a couple of years ago, China is experiencing something similar to what Japan saw after its real estate and stock market bubbles burst in the early 1990s: a deceleration in economic growth, a surge in government borrowing and a collapse in interest rates and bond yields. There was a prolonged period of price deflation too; this is sometimes called a ‘balance sheet recession’: after a period of enduring and rapid growth in bank lending (largely collateralised on real estate), property prices eventually start to fall, and the banks are ultimately saddled with bad loans and an inability to make new loans. A long period of malaise (or a shorter period of depression!) sets in. So great was the Japanese bubble that it took roughly thirty years for Japan to break out of its malaise, finally recovering to its previous peak in 1989 at the start of the year. We don’t know how things will develop in China, with its different cultural norms and political institutions, but for now the comparisons with Japan will continue. An important difference for investors to bear in mind is that Japanese shares were very expensive (i.e. with high price to earnings ratios) at the start of their balance sheet recession in the 1990s, whereas Chinese shares today trade very cheaply indeed.

Other types of assets

Gold was one of the best performing assets last year, rising by over 29% in Sterling terms. As with bonds, analysts have struggled to explain exactly why the gold price has risen so much. Theories put forward in the past few years have included central bank buying, geopolitical tensions, falling interest rates, excess liquidity, declining real yields… maybe it’s just that ‘paper money’ is becoming less valuable in comparison to the scarce metal? Whatever the reason, financial history shows that having a proportion of assets invested in gold has made sense, largely by offering stability during turbulent times. A modest proportion of each of our clients’ portfolios is invested in an exchange traded fund that holds physical gold at the Royal Mint.

Commodity prices, such as those for oil or copper, mostly meandered throughout the year.

Property assets, which generate rental income and the possibility of capital gains or losses, were also largely lacklustre during 2024. There were some signs of a recovery in UK property sentiment, but rising bond yields tempered enthusiasm in the USA. As mentioned last quarter, our clients benefited from a takeover bid for the UK real estate investment trust, Balanced Commercial Property Trust, which was held across unconstrained portfolios. The takeover deal was successfully completed in November.

Politics and geopolitics

2024 was certainly a year of elections, with roughly half the world’s population voting in one way or another. The general pattern was one of incumbents getting voted out, with many political analysts citing higher consumer prices as the main reason for voter discontent. Whatever the specific reasons, it seems that around the world, many citizens’ expectations are not being met right now, and voters sent a message to incumbent politicians. But every election was unique, with some of the most exciting events seen in Romania (election annulled), South Korea (martial law announced temporarily, and then an arrest warrant issued for the President), France (a volley of new Prime Ministers) and Georgia (mass demonstrations and a refusal by the outgoing President to quit). India’s was the biggest vote, but for investors – at least in the short-term – it was the USA that mattered most.

Conflicts continued worldwide, with escalation in the Russia/Ukraine war and in the Middle East. Less well reported is that large parts of Africa are also involved in conflicts and civil wars. Unexpected events, like the sudden collapse of the Syrian regime, show our limited ability for gauging the implications of conflict. Amidst such events, very little seemed to affect major asset markets directly. This does not mean that investments are unaffected by war – any study of financial history would quickly dispel that notion.

In his book, The Psychology of Money, Morgan Housel writes that our attitude to money and investing is heavily shaped by our personal experiences of say, hardship, inflation or economic bountifulness.

This can lead folk from different generations or places to hold completely different views on investing. The most recent cohort of global investors has generally experienced easy, one-click access to a huge variety of assets and a hosepipe of information (and misinformation!) via social media; and generally abundant liquidity from the US Federal Reserve. It’s important to be open-minded to possible futures that differ completely from what we have experienced to date.

Artificial Intelligence

For some time now, we have been examining, and reporting on, the news and evidence on AI to see what profitable end-market uses are emerging. In some ways, little has changed in the past year. The sale of semiconductors for AI model training and for building data centres continues apace, but profitable end uses remain limited. We’ve found examples of profitable AI applications in foreign exchange market-making, essay writing and language translation services; but the scale of these examples in no way matches the investments made to date into AI by the ‘hyperscalers’, large tech firms such as Nvidia. It’s not at all clear whether the capital expenditure boom will produce a good return on investment or reveal itself over time to be largely malinvestment. AI will almost certainly be an important part of our lives, but that is not the same thing as saying it will prove a profitable investment. As stocks like Palantir Technologies (building “platforms for managing data plus applications for machine-assisted analysis”) rose five-fold last year, others, like Chegg (offering “personalised learning assistants leveraging the power of AI”) plummeted by 85%. The sheer volatility seen in these share prices suggests uncertainty, and big differences of opinion amongst investors.

How we invested

Broadly and more recently, we have reduced exposure to Asian-ex-Japan shares, and added to US equity, in recognition of the political changes in the USA. While the US stock market as a whole looks to be overpriced relative to expected cash flows, it is still possible to find pockets of value, especially among firms paying high but sustainable dividends.

Portfolios remain well balanced between global equities, bonds, infrastructure, gold and cash. We wrote a year ago that cryptocurrencies were beyond our risk appetite for client portfolios, and this remains the case.

Outlook

Governments around the world (or at least those with strong political opponents) are struggling to pass budgets, as expectations for what the state should do, or promised to do for citizens, generally exceed their ability to pay for it all. As a result, anticipating political ‘events’ (lots of them!) for the year ahead looks like an easy forecast. From January 20th, we’ll see which policy measures Donald Trump and his team actually implement. All the while, recall that Trump has professed to enjoy using leverage to strike any kind of deal that suits him personally. It seems reasonable to expect a series of announcements of higher defence spending by European governments, even if the Russia/Ukraine war is frozen. This poses a significant challenge for the Labour Party following their summer election victory, as highlighted by Rachel Reeves in her first budget, where she sought to address the persistent shortfalls in the UK’s finances. Her cautious fiscal approach, with higher taxes and lower spending, may weigh on the UK stock market and limit growth, while the bond market could see some support but remain sensitive to broader economic pressures. Changes in supply chains worldwide have been substantial in recent years, with Covid-19 and then sanctions on Russia, and now expected tariff increases (threatened or made real). This creates costs for businesses and consumers at first, with longer term effects more difficult to predict.

Asset markets could do almost anything in the year ahead, especially in the USA where valuations today compared to history are high, while offering little guidance at all for the short term. Pockets of cheapness can be found in UK equities and smaller Japanese stocks. Short-dated government bonds offer modestly positive real returns with low risk. Overall, having a balanced portfolio of assets with sensibly calibrated expectations looks like a good way to proceed.

The Year in Charts

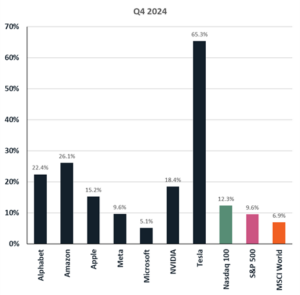

The importance of being close to Trump for Musk and Tesla in Q4, as the US ‘Magnificent 7’ tech/AI theme dominates in 2024.

Source: Morningstar. Share price returns in GBP for 2024.

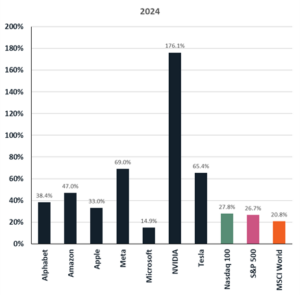

‘Nothing to see here’ for bonds, but Gold strong, and the US leads the pack for equities.

Source: Morningstar. Major fixed interest and equity market indexes. Data in GBP for 2024.

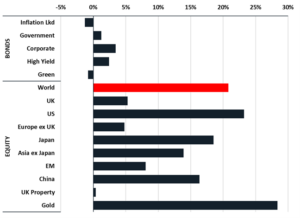

Gold continues to outperform equity.

Source: Morningstar. Gold = Royal Mint Responsibly Sourced Physical Gold ETC. Data in GBP for 2024.

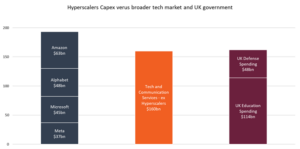

Expenditure on tech/AI by the Hyperscalers greater than wider tech/comms sector combined. Sir Keir Starmer’s plans for Defence and Education spending as a comparison for scale.

Source: MMW Investment Team, US Tech Sector (Morningstar), HM Treasury and Office for Budget Responsibility 2024-2025 forecast.

Key facts about the world

United Kingdom

- Economy shows signs of stagnating growth in Q4, with GDP projections downgraded to 0% for the quarter.

- Inflation remained above the Bank of England’s 2% target, rising from 1.7% in September to 2.3% in October and 2.6% in November.

- In response, the Bank of England made a second cut to interest rates for the year in November from 5% to 4.75%.

Europe

- Eurozone economy remains fragile, with survey indicators reflecting a contraction in overall activity for the second consecutive month in December.

- The composite Purchasing Managers Index remained below the growth threshold of 50 despite rising to 49.6 in November.

- The European Central Bank reduced key rates to 3%, with 0.25% cuts in October and December, marking 4 cuts for the year aimed at restimulating economic growth amid persistent economic challenges.

Asia

- Following the Japanese general election in October, Shigeru Ishiba’s Liberal Democratic Party secured a decisive victory, consolidating his leadership and providing a mandate for proposed economic reforms.

- The unwinding of the Japanese Yen carry trade continued to impact global financial markets, contributing to increased volatility and affecting investor sentiment.

- The Chinese government announced an additional stimulus package worth £50 billion in November, focusing on infrastructure projects and tax reliefs to bolster slowing economic growth.

North America

- The US presidential election concluded with Donald Trump securing a historic and sweeping re-election, leading to market optimism regarding potential tax cuts and deregulation policies.

- Despite a buoyant market, the Federal Reserve continued its rate cuts over the quarter with 0.25% in November and December, bringing the rate from 5% to 4.5%.

- Expectations for 2025 are for a further 2 rate cuts only, falling from a forecast 4 cuts as recently as Q3 2024.

South America

- In October 2024, the International Monetary Fund (IMF) revised its growth forecast for Latin America and the Caribbean, projecting 2.1% GDP growth for 2024, up from the previously estimated 1.8%. This adjustment reflects stronger-than-expected performances in major economies like Brazil, which is now expected to grow by 3.0% due to robust private consumption and investment.

- Brazil’s central bank raised interest rates by a full percentage point to 12.25% in December, indicating that similar rate increases are likely in the next two meetings, aiming to control inflation, which stood at 4.9% in November.

Africa

- The International Monetary Fund (IMF) maintained its regional growth forecast at 3.6% for 2024, noting that commodity-intensive economies are growing at half the rate of diversified ones.

- South Africa revised its economic growth target downward to 1.1% from 1.3% for 2024, with an average forecast of 1.8% growth over the next three years. This adjustment comes amid ongoing economic challenges, including lower-than-expected tax collection and rising government debt.

Q4 2024 Performance Review

Unconstrained strategies

Key facts

Challenging quarter, with the US and tech/AI themes again leading

Japan and China strong amid volatility

Emerging Markets allocation increased

UK and Europe under pressure in Q4, but modest gains for the year

Gold shines and value in infrastructure

Bonds mixed, longer duration hurt by inflation/interest rate shifts

Summary

While December didn’t provide the hoped for seasonal ‘Santa Rally’ for global markets, it was yet another strong period to end the year for the US as areas of the equity market expected to benefit from Trumps’ return to the White House were given a boost. For the final quarter of 2024, and year, it was a now familiar story of the US, with the Tech/AI theme dominating. It will therefore come as no surprise to see that the standout performance in portfolios came from this area also, with the Natixis Loomis Sayles US Equity Leaders fund +18.1% in Q4 and 37.8% for the year. Reflecting how narrow returns have been, the Xtrackers S&P 500 Equal Weight ETF which has the same size position for each of the 500 largest US companies in the index (de-emphasising the dominant tech companies), only returning 5.7% in Q4 and 7.4% for the year.

Outside of the US, returns from all other geographic regions have been disappointing, with only Japan and China trying to keep pace – and this amidst some extreme volatility. Changes were made within these allocations, with the Zennor Japan fund +11.6%, and Fidelity Asia +11.1% with its focus on China. The Fidelity fund made way for an increase to wider Emerging Markets in Q4, retaining a lower exposure to China, and also a marginal increase to US equities as we expect to see continued performance here into 2025.

The UK and Europe have faced their own challenges, particularly from significant political change, which has seen somewhat lacklustre returns, albeit positive for the year. While the Premier Miton European Opportunities fund (+1.4% in Q4 and +4.6% for 2024) remains well ahead of its benchmark and peer group, it has been a victim of the lack of interest in the region, as well as investors taking money out of Europe as the politics became more unstable. This is where the UK was prior to the landslide victory of the Labour Party in July, but the semblance of calm that came with the result unfortunately didn’t translate to a strong finish to the year. However, all UK funds had a positive outcome, with strength in the RGI UK Recovery fund (+9.5%) and Vanguard FTSE 250 ETF (+7.8%) the better contributors to performance over the year.

In other assets, it has been gold which has seen the best returns outside of the US. The Royal Mint Responsibly Sourced Physical Gold ETC has returned +25.2% for the year despite a slightly negative return in Q4 of -1.6%.

We retain the position for now as a valuable portfolio diversifier going into the uncertainty for 2025 and expected volatility. Among the other alternative investments, the Downing Renewables & Infrastructure Trust showed signs of recovery over the year, despite ending down -8.1%.

We continue to believe assets within the renewable energy and infrastructure space remain undervalued and have built a position in the VT Gravis UK Infrastructure fund (-1.8% in Q4) over the last several months, taking advantage of the attractive valuations.

During the quarter, the takeover of Balanced Commercial Property Trust was completed, marking the conclusion of an investment journey that, despite challenges in the UK property sector, has delivered a positive outcome. UK property trusts, including this one, have faced sustained pressure in recent years, trading at deep discounts to their underlying asset values. However, throughout this period, we have maintained patience while accruing the trust’s attractive yield. This approach has been rewarded by Starwood Bidco’s bid of 96p per share. The total return generated from this holding (51.5% over the 12 months to the end of November) has proven to be worthwhile, highlighting the importance of a long-term investment perspective even during challenging times.

Within the fixed interest elements of strategies, as mentioned in the main commentary, returns have broadly been disappointing. Funds with a longer duration profile (bonds with longer to maturity/repayment) have been negatively impacted by the changes in inflation and interest rate expectations compared to the outset of 2024: L&G All Stocks Index Linked Gilt Index -8.1%, Amundi UK Government Bond ETF -3.4%. For those bonds with a shorter duration however, we have seen a positive outcome over the year despite the volatility affecting all bonds in Q4: M&G UK Inflation Linked Corporate Bond +3.6%, iShares $ Treasury Bond 1-3 Year ETF +3.8% and Artemis Corporate Bond +3.2%. Going forwards we continue to see these bond holdings as an important defensive element within diversified strategies, where there continue to be a range of factors such as geopolitical unrest, war, trade tariffs, inflation and interest rate changes among them, that could easily derail the universally positive view many have for 2025.

| SECTOR | Q4 2024 | 1 year to 31/12/24 | 1 year to 31/12/23 | 1 year to 31/12/22 | 1 year to 31/12/21 | 1 year to 31/12/20 | 5 years (annualised) |

|---|---|---|---|---|---|---|---|

| IA UK Index Linked Gilts | -6.8% | -9.6% | 0.5% | -35.3% | 3.9% | 11.9% | -7.3% |

| IA £ Corporate Bond | -0.4% | 2.6% | 9.3% | -16.4% | -2.0% | 7.9% | -0.2% |

| IA Property | -1.2% | 0.4% | -0.4% | -7.8% | 7.4% | -3.8% | -1.0% |

| IA UK Equity Income | -1.4% | 8.7% | 7.1% | -2.2% | 18.3% | -10.9% | 3.7% |

| IA UK Smaller Companies | -1.9% | 6.3% | 0.4% | -25.6% | 20.6% | 7.0% | 0.5% |

| IA North America | 8.5% | 22.0% | 16.7% | -10.1% | 25.2% | 16.5% | 13.3% |

| IA Europe Excluding UK | -4.0% | 1.8% | 14.3% | -8.9% | 15.6% | 10.5% | 6.2% |

| IA Japan | 1.6% | 8.6% | 11.0% | -8.4% | 1.6% | 13.9% | 5.0% |

| IA Asia Pacific Excluding Japan | -1.1% | 10.0% | -0.9% | -6.8% | 1.5% | 19.9% | 4.3% |

| IA Global Emerging Markets | -1.1% | 8.0% | 4.3% | -12.3% | -0.3% | 13.6% | 2.3% |

Source: Morningstar in GBP. Net income reinvested. Past performance is not a reliable indicator of future results.

The positioning of our Unconstrained strategies

Cautious

Growth

Balanced

Adventurous

Q4 2024 Performance Review

Ethical strategies

Key facts

Broader shift to US tech/AI and speculative assets sees outflows from Ethical/ESG strategies

UK and Europe attractive valuations continue to be overlooked

Short duration bonds favourable while long duration struggles

Rising power demand for industry such as AI risks slowing fossil fuel phase-outs, testing green commitments in 2025

Solar installations and EV sales growth underline long-term opportunities

Alternatives such as renewables remain attractive, gold shines

Summary

While a narrow section of the US equity market enjoyed a late surge in Q4 following the sweeping victory of Donald Trump and the Republicans in November, for investors with an ESG (environmental, social and governance) or Ethical focus in their investments, the year has been tough, and not entirely “fair”, despite the broadly positive outcome.

Throughout 2024 we have seen a continual outflow from not just every other region to the US, but also from investments considered to be ethical, as investors have increasingly focused on (chased?) the tech/AI theme, and more recently cryptocurrencies as well. This poses any number of issues for ethical strategies, not least of which is the higher number of ESG and ethically advanced companies across regions such as northern Europe which remain deeply out of favour, compared to the US and investments of questionable foundation such as Bitcoin.

As such, within the strategies we have a limited list of investments that have performed very well, versus everything else. The iShares US Equity ESG Screened and Optimised Index fund has returned +25.7% over the year, despite a marginally negative Q4 (-0.8%) as flows shifted dramatically within the US itself. Globally diversified funds with a higher exposure to the US have also enjoyed a relatively strong year despite the volatility of Q4: Janus Henderson Global Sustainable Equity +12.7% (-3.4% in Q4), Liontrust SF Global Growth and BNY Mellon Sustainable Global Equity Income +8.8% and +8.7% respectively (-1.4% and -1.7% in Q4).

The UK and other regions have been lacklustre, although one standout position has been the Vanguard ESG Emerging Markets All Cap Equity Index +13.8% (+2% in Q4) which has benefitted from its exposure in China. While it has been volatile over the course of the year since initiated at the end of 2023, the various stimulus packages from the Chinese leadership have provided a reassuring boost at each intervention and helped stabilise some of their key trading partners in the region despite the volatile US Dollar and geopolitical events and threats of increased tariffs under Trump’s administration.

In other assets, it has been gold which has seen the best returns outside of the US. The Royal Mint Responsibly Sourced Physical Gold ETC has returned +25.2% for the year despite a slightly negative return in Q4 of -1.6%. We retain the position for now as a valuable portfolio diversifier going into the uncertainty for 2025 and expected volatility. Among the other alternative investments, the Downing Renewables & Infrastructure Trust showed signs of recovery over the year, despite ending down -8.1%. We continue to believe assets within the renewable energy and infrastructure space remain undervalued and have built a position in the VT Gravis UK Infrastructure fund (-1.8% in Q4) over the last several months taking advantage of the attractive valuations.

Within the fixed interest elements of the ethical strategies, as mentioned in the main commentary, returns have broadly been positive outside of any longer duration bonds (bonds with longer to maturity/repayment). While the Aegon Ethical Corporate Bond and Liontrust SF Corporate Bond have been lacklustre +3.2% and +2.3% respectively in 2024, the Rathbone Ethical Bond fund +5.1% managed to hold onto gains somewhat better as Q4 saw a negative return for each of them. For those bonds with a shorter duration and more cash-like profile, we have seen a more positive outcome: BlackRock ICS Sterling Liquidity Environmentally Aware +5.2% and Vontobel TwentyFour Sustainable Short Term Bond funds +5.8%, for the year, and maintaining their low, but sustainable and positive returns even in Q4 (+0.4% and +0.2% respectively).

Going forwards we continue to see these bond holdings as an important defensive element within diversified strategies, where there continue to be a range of factors that could derail portfolios. For example, while there are record solar installations being made, and rising electric vehicle sales to fight against global warming, this could easily disrupt the green transition in 2025 as power demand from the US to Europe, to Japan, significantly increases, forcing a rethink on the phasing out of fossil fuel power stations.

| SECTOR | Q4 2024 | 1 year to 31/12/24 | 1 year to 31/112/23 | 1 year to 31/12/22 | 1 year to 31/12/21 | 1 year to 31/12/20 | 5 years (annualised) |

|---|---|---|---|---|---|---|---|

| Global Sustainable | 3.4% | 15.6% | 12.9% | -10.0% | 19.7% | 10.3% | 9.2% |

| UK ESG Enhanced | 0.0% | 10.2% | 10.8% | -3.7% | 19.0% | -11.7% | 4.3% |

| US ESG Enhanced | 9.3% | 26.3% | 20.0% | -11.1% | 29.8% | 16.9% | 15.4% |

| Developed Market Europe Sustainable | -3.8% | 4.4% | 13.7% | -11.4% | 20.3% | 9.0% | 6.7% |

| Emerging Market ESG Enhanced | -1.9% | 5.4% | 2.2% | -11.1% | -2.6% | 8.6% | 0.3% |

| UK Corporate Bond Sustainable | -0.6% | 1.2% | 9.6% | -20.7% | -3.4% | 9.0% | -1.5% |

| Global Corporate Bond Sustainable | 2.4% | 2.2% | 3.4% | -6.9% | -2.7% | 7.6% | 0.6% |

| Global Green Bond | 0.3% | -1.0% | 4.4% | -13.0% | -7.0% | 9.3% | -1.8% |

| Global Renewable Energy | -3.1% | 1.4% | 1.9% | -1.2% | 12.0% | 23.7% | 7.2% |

Source: Morningstar sustainable indices in GBP. Net income reinvested. Past performance is not a reliable indicator of future results

The positioning of our Ethical strategies

Cautious

Growth

Balanced

Adventurous

Disclaimer

Opinions constitute our judgment as of this date and are subject to change without warning. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The information in this document is not intended as an offer or solicitation to buy or sell securities or any other investment, nor does it constitute a personal recommendation.